What is Payable Ledger Account?

Imagine you are keeping track of the money you owe to different people. You have a notebook where you write down the names of the people you owe money to and how much you owe them. Each person has their own page in the notebook.

A Payable Ledger Account is like that notebook. It is a special account that a business uses to keep track of the money it owes to its suppliers or vendors. Just like your notebook, each supplier or vendor has their own “page” in the account.

In the Payable Ledger Account, the business records important information about each supplier, like their name, the amount of money owed, and the due date for payment. When the business receives an invoice from a supplier, they write down the details on the supplier’s page in the account.

This Payable Ledger Accounts helps the business stay organized and keep track of all the money it owes. It helps the business know who they owe money to, how much they owe, and when the payments are due. It’s like a to-do list for paying bills.

By keeping an accurate Payable Ledger Account, the business can make sure they pay their suppliers on time and avoid any late payment fees or problems. It also helps the business have a clear picture of their financial obligations and manage their money better.

Table of Contents

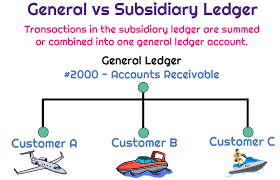

Payable Ledger Account is different from Account Payable ledger

In accounting, the terms “Payable Ledger Account” and “Accounts Payable Ledger” are often used interchangeably, referring to the same concept.

The term “Accounts Payable Ledger” is more commonly used in practice to describe the record-keeping system that tracks and manages a company’s unpaid bills and invoices. It serves as a centralized ledger where all the accounts payable transactions are recorded, including supplier details, invoice information, payment due dates, and payment history.

So, in simple terms, the “Payable Ledger Account” and “Accounts Payable Ledger” both refer to the same ledger used to keep track of a company’s outstanding bills and invoices, ensuring timely payments and accurate financial record-keeping.

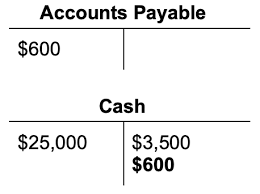

Is Accounts Payable Ledger a Debit or Credit?

In accounting, the Accounts Payable Ledger is a type of account that is recorded on the credit side.

To understand this, let’s briefly explain the basic principles of double-entry bookkeeping. Every transaction in accounting has two sides: a debit and a credit. Debits and credits are used to record changes in various accounts.

In the case of the Accounts Payable Ledger, it represents the amounts owed by a business to its suppliers. When a company receives an invoice from a supplier, it records the transaction as a credit entry in the supplier’s account in the Accounts Payable Ledger. This credit entry increases the accounts payable balance, reflecting the liability the company has towards the supplier.

On the other hand, when the company makes a payment to the supplier, it records the transaction as a debit entry in the supplier’s account, reducing the accounts payable balance.

So, to summarize, the Accounts Payable Ledger is increased (credited) when a liability is incurred, and it is decreased (debited) when the liability is settled or paid off. Therefore, the Accounts Payable Ledger is recorded on the credit side of the ledger.

Treatment of Accounts Payable Ledger Example

Treatment of an Accounts Payable Ledger refers to how transactions related to accounts payable are recorded and managed in the accounting system. In simple terms, it means how the money you owe to suppliers is tracked and processed in the company’s financial records. Let’s explain this with an example:

Imagine you have a small business that sells handmade products. You purchase materials from different suppliers to make your products. Here’s how the treatment of an Accounts Payable Ledger Example works:

- Recording Purchases: When you receive an invoice from a supplier for the materials you purchased, you record it in the Payable Ledger. Let’s say you bought $500 worth of materials from Supplier A. You would enter this information in the Payable Ledger Account under Supplier A, mentioning the invoice amount and date.

- Updating the Balance: The Payable Ledger Account keeps a running balance for each supplier. So, if you already owed Supplier A $200 from a previous purchase, your updated balance in the Payable Ledger Account would be $700 ($200 previous balance + $500 new purchase).

- Due Dates: The Payable Ledger Account also includes the due dates for payments. Let’s say Supplier A gives you 30 days to make the payment. You would note the due date accordingly, which is the date by which you should pay the $700 to Supplier A.

- Making Payments: When you make the payment to Supplier A, you update the Payable Ledger Account to reflect the payment. Let’s say you paid $500 to Supplier A. You deduct this amount from the balance, so your updated balance in the Payable Ledger Account would be $200 ($700 previous balance – $500 payment).

- Reconciliation: Periodically, you reconcile the Payable Ledger with your bank statements or payment records to ensure accuracy. This process involves cross-checking the payments made with the recorded transactions in the Payable Ledger Account to identify any discrepancies.

By following this treatment of the Payable Ledger Accounts, you can effectively track the money you owe to suppliers, manage your accounts payable, and ensure timely payments. It provides a clear picture of your liabilities and helps maintain accurate financial records for your business.

How do you record accounts payable in a ledger?

To record accounts payable in a ledger, you follow these steps:

- Identify the Supplier: Start by identifying the supplier or vendor to whom you owe money. This could be a company that provided goods or services to your business.

- Create a Supplier Account: Set up a separate account in the Accounts Payable Ledger for the supplier. Assign a unique identifier or name to the account.

- Record the Invoice Details: When you receive an invoice from the supplier, record the relevant information in the supplier’s account. This includes the invoice number, invoice date, description of goods or services, and the amount owed.

- Allocate the Amount: Determine the appropriate account to allocate the expense. For example, if it’s a utility bill, you would allocate it to the “Utilities Expense” account. This step ensures that the expense is correctly categorized in the general ledger.

- Update the Supplier Account: Record the amount owed to the supplier in their account as a credit entry. This increases the accounts payable balance for that supplier.

- Track Payments: As you make payments to the supplier, update their account in the Accounts Payable Ledger. Record the payment amount as a debit entry, reducing the accounts payable balance.

- Reconcile Regularly: Periodically reconcile the supplier accounts in the Accounts Payable Ledger with bank statements and payment records. This ensures that the ledger accurately reflects the payments made and any outstanding balances.

By following these steps, you maintain an accurate record of your accounts payable in the ledger. The ledger provides a comprehensive view of the amounts owed to suppliers, facilitates timely payments, and aids in financial reporting and analysis.