The Main Difference Between Statutory Audit And Secretarial Audit

Statutory audit and secretarial audit are both types of audits that companies may need to undergo to ensure compliance with regulatory requirements. However, they serve different purposes and focus on different aspects of a company’s operations.

The main difference between a Statutory audit and a secretarial audit, Statutory audit, also known as a financial audit, is conducted to verify the accuracy and completeness of a company’s financial statements, including its balance sheet, income statement, and cash flow statement. The purpose of a statutory audit is to provide assurance to stakeholders, such as investors, lenders, and regulators, that the financial information presented by the company is reliable and accurate. The audit is typically conducted by an independent external auditor who examines the company’s financial records and reports any discrepancies or issues that need to be addressed.

On the other hand, a secretarial audit is conducted to ensure compliance with various legal and regulatory requirements related to corporate governance and company law. The focus of secretarial audit is on the company’s compliance with various laws, rules, and regulations related to its operations, such as the Companies Act, SEBI regulations, and other applicable laws. The audit is typically conducted by a qualified company secretary who examines the company’s records and reports any non-compliance or deficiencies that need to be addressed.

In summary, while the statutory audit is focused on the accuracy and completeness of a company’s financial statements, the secretarial audit is focused on ensuring compliance with various legal and regulatory requirements related to corporate governance and company law. Both audits are important for companies to undergo to ensure transparency, accountability, and compliance with regulatory requirements.

Table of Contents

Point-wise Difference Between Statutory Audit and Secretarial Audit

Here are some key differences between statutory audit and secretarial audit, presented in a point-wise manner:

- Purpose: The primary purpose of a statutory audit is to verify the accuracy and completeness of a company’s financial statements, while the purpose of a secretarial audit is to ensure compliance with various legal and regulatory requirements related to corporate governance and company law.

- Focus: The focus of a statutory audit is on the financial information presented by the company, such as its balance sheet, income statement, and cash flow statement. In contrast, the focus of a secretarial audit is on the company’s compliance with various laws, rules, and regulations related to its operations.

- Conducting Authority: A statutory audit is typically conducted by an independent external auditor who is qualified and licensed to conduct audits. A secretarial audit, on the other hand, is conducted by a qualified company secretary who is appointed by the company.

- Reporting Requirements: A statutory audit report is required to be submitted to the stakeholders, such as investors, lenders, and regulators, along with the company’s financial statements. In contrast, a secretarial audit report is required to be submitted to the board of directors and shareholders of the company.

- Frequency: A statutory audit is conducted annually, as mandated by law. A secretarial audit, however, may be conducted periodically, as required by the relevant laws and regulations.

- Scope: The scope of a statutory audit is limited to the financial information presented by the company, while the scope of a secretarial audit is broader and covers various aspects of the company’s operations, including compliance with company law, corporate governance, and other applicable laws and regulations.

In summary, while both statutory audit and secretarial audit are important for companies to undergo to ensure transparency, accountability, and compliance with regulatory requirements, they serve different purposes and focus on different aspects of a company’s operations.

Here Are Some Key Difference Between Statutory Audit and Secretarial Audit, As Per The Companies Act, 2013:

- Purpose: As per Section 143(2) of the Companies Act, 2013, a statutory audit is conducted to verify the accuracy and authenticity of a company’s financial statements. In contrast, as per Section 204 of the Companies Act, 2013, a secretarial audit is conducted to ensure compliance with various legal and regulatory requirements related to company law and corporate governance.

- Conducting Authority: A statutory audit is conducted by an independent external auditor who is appointed by the company’s board of directors. A secretarial audit, however, is conducted by a qualified company secretary who is appointed by the company’s board of directors.

- Reporting Requirements: As per Section 143(3) of the Companies Act, the statutory auditor is required to submit an audit report to the company’s board of directors, along with the company’s financial statements. In contrast, as per Section 204(1) of the Companies Act, the secretarial auditor is required to submit a secretarial audit report to the company’s board of directors and to the Registrar of Companies.

- Frequency: A statutory audit is mandatory for all companies and is conducted annually, as per Section 139 of the Companies Act. A secretarial audit is mandatory for certain types of companies, such as public companies with a paid-up share capital of Rs. 50 crore or more, or companies with an annual turnover of Rs. 250 crore or more. The frequency of secretarial audit may vary depending on the company’s specific requirements.

- Scope: The scope of a statutory audit is limited to the financial statements and related records of the company. The auditor examines the financial statements to ensure that they are prepared in accordance with the applicable accounting standards and are free from material misstatements. In contrast, the scope of a secretarial audit is broader and covers various aspects of the company’s operations, including compliance with company law, corporate governance, and other applicable laws and regulations.

Comparison Table for Differences Between Statutory Audit And Secretarial Audit

| Aspect | Statutory Audit | Secretarial Audit |

|---|---|---|

| Purpose | To verify the accuracy and authenticity of a company’s financial statements. | To ensure compliance with various legal and regulatory requirements related to company law and corporate governance. |

| Conducting Authority | An independent external auditor appointed by the company’s board of directors. | A qualified company secretary appointed by the company’s board of directors. |

| Reporting Requirements | An audit report submitted to the company’s board of directors, along with the company’s financial statements. | A secretarial audit report submitted to the company’s board of directors and to the Registrar of Companies. |

| Frequency | Mandatory for all companies and conducted annually. | Mandatory for certain types of companies, and the frequency may vary depending on the company’s specific requirements. |

| Scope | Limited to the financial statements and related records of the company, ensuring they are prepared in accordance with applicable accounting standards and free from material misstatements. | Broader, covering various aspects of the company’s operations, including compliance with company law, corporate governance, and other applicable laws and regulations. |

Examples Of Difference Between Statutory Audit And Secretarial Audit

Here are some examples that illustrate the difference between statutory audit and secretarial audit:

- Example of Statutory Audit: ABC Ltd., a publicly traded company, hires an independent external auditor to conduct a statutory audit of its financial statements for the fiscal year ending March 31, 2023. The auditor examines the financial statements to ensure they are prepared in accordance with applicable accounting standards and free from material misstatements. The auditor also examines the supporting documents and records related to the financial statements.

- Example of Secretarial Audit: XYZ Ltd., a publicly traded company with a paid-up share capital of Rs. 75 crore, hires a qualified company secretary to conduct a secretarial audit of its operations for the fiscal year ending March 31, 2023. The company secretary examines various aspects of the company’s operations, including compliance with company law, corporate governance, and other applicable laws and regulations. The company secretary reviews the company’s minutes books, registers, annual reports, board resolutions, and other documents to ensure that they comply with the applicable legal and regulatory requirements.

What is Statutory Audit?

Statutory audit is an independent review of a company’s financial statements and related records, which is conducted by a qualified external auditor who is appointed by the company’s board of directors. The primary objective of a statutory audit is to verify the accuracy and authenticity of the company’s financial statements and to ensure that they are prepared in accordance with applicable accounting standards and regulations.

The statutory audit is mandatory for all types of companies in India, as per the Companies Act, 2013. The audit is conducted annually, and the auditor is required to provide an audit report to the company’s board of directors, along with the financial statements. The report includes the auditor’s opinion on whether the financial statements present a true and fair view of the company’s financial position and performance.

During a statutory audit, the auditor examines the company’s financial records, such as its income statements, balance sheets, cash flow statements, and other related documents, to verify their accuracy and completeness. The auditor also checks the company’s compliance with relevant accounting standards, company law provisions, and other applicable laws and regulations.

The auditor performs various tests and procedures to obtain sufficient and appropriate audit evidence to support the audit opinion. These procedures include testing the company’s internal controls, reviewing significant transactions, and assessing the risk of material misstatement in the financial statements.

The audit process typically involves several stages, including planning, risk assessment, testing, and reporting. The auditor prepares a detailed audit plan, which outlines the scope, objectives, and methodology of the audit. The auditor also assesses the risk of material misstatement in the financial statements and designs procedures to address those risks. The auditor then tests the company’s financial records and internal controls to obtain audit evidence. Finally, the auditor prepares an audit report, which summarizes the findings and conclusions of the audit.

In summary, a statutory audit is a mandatory annual review of a company’s financial statements, which is conducted by an independent external auditor to ensure compliance with applicable accounting standards and regulations. The audit process involves various stages, including planning, risk assessment, testing, and reporting, and aims to provide reasonable assurance on the accuracy and authenticity of the financial statements.

What is Secretarial Audit?

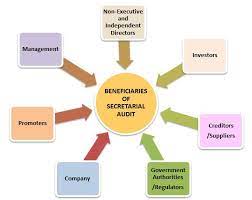

The secretarial audit is a type of audit that focuses on the compliance of a company with the applicable laws and regulations related to company law and corporate governance. The main objective of a secretarial audit is to ensure that the company is complying with the legal requirements related to its operations, and that it is functioning in a transparent and ethical manner.

A secretarial audit is usually conducted by a qualified company secretary who is appointed by the company’s board of directors. The audit covers various aspects of the company’s operations, including compliance with company law, corporate governance, and other applicable laws and regulations.

During a secretarial audit, the company secretary reviews the company’s documents, books, and records, to ensure that they comply with the relevant laws and regulations. This includes the company’s articles of association, minutes of meetings, registers of members, directors, and auditors, annual reports, and other documents related to the company’s operations.

The company secretary also evaluates the company’s compliance with various laws and regulations, including the Companies Act, Securities and Exchange Board of India (SEBI) regulations, and other applicable laws and regulations. This involves assessing the company’s compliance with the provisions related to share capital, share transfer, dividends, board meetings, general meetings, and other legal and regulatory requirements.

After conducting the secretarial audit, the company secretary prepares a report that summarizes the findings and observations of the audit. The report highlights any areas where the company is not in compliance with the relevant laws and regulations and provides recommendations for corrective action. The report is submitted to the company’s board of directors and is also made available to other stakeholders, such as shareholders and regulatory authorities.

In summary, a secretarial audit is a review of a company’s compliance with the applicable laws and regulations related to company law and corporate governance. The audit is conducted by a qualified company secretary and covers various aspects of the company’s operations, including compliance with legal and regulatory requirements related to share capital, share transfer, dividends, board meetings, general meetings, and other relevant areas. The report provides recommendations for corrective action and is submitted to the company’s board of directors and other stakeholders.

References for Difference Between Statutory Audit and Secretarial Audit

- https://www.icsi.edu/media/webmodules/companiesact2013/FAQs%20on%20Secretarial%20Audit.pdf

- https://www.nbccindia.com/pdfData/Tenders/NBCC_TenderDocSecreterailAuditor14032022.pdf