NFRA-1 and NFRA-2- In the kingdom of corporate governance under the Companies Act, of 2013, two important forms emerged to ensure comprehensive oversight and compliance: NFRA-1 and NFRA-2. These forms served distinct purposes and required different actions from auditors and companies. Here, we shall delve into the intricacies of these forms with a practical example to highlight their differences.

NFRA-1: Notification by Companies

Purpose: NFRA-1 is a form used by companies to inform the National Financial Reporting Authority (NFRA) about their auditor(s). This form is essential for establishing a record of auditors associated with companies under NFRA’s purview.

Who Must File: Companies that fall under the jurisdiction of NFRA, such as listed companies and certain large unlisted public companies, are required to file NFRA-1.

Filing Deadline: The form must be filed by the company within 30 days of the appointment of an auditor.

Key Details in NFRA-1:

- Company identification details (CIN, name, address, etc.)

- Details of the auditors appointed (name, membership number, firm registration number, etc.)

- Date of the auditor’s appointment

- Details of the financial year for which the auditor is appointed

Practical Example: Consider a publicly listed company, XYZ Ltd., which has recently appointed a new auditor, ABC & Co. Chartered Accountants. XYZ Ltd. must file the NFRA-1 form within 30 days of appointing ABC & Co., providing all relevant details about the auditor and the period of their appointment. This filing helps NFRA maintain an updated record of auditors associated with companies it oversees.

NFRA-1 and NFRA-2

NFRA-2: Annual Return by Auditors

Purpose: NFRA-2 is an annual return that auditors of companies within NFRA’s jurisdiction must file. This form provides detailed information about the auditor’s activities, audit reports, and compliance with auditing standards.

Who Must File: Auditors of companies covered by NFRA, including auditors of listed companies and certain large unlisted public companies, are required to file NFRA-2.

Filing Deadline: The form must be filed annually by November 30th of the year following the financial year to which it relates. Further Explained below

Key Details in NFRA-2:

- General information about the auditor (name, membership number, firm registration number, etc.)

- Details of audit reports issued during the financial year

- Information on the audit fees received

- A declaration of compliance with auditing standards and ethical guidelines

- Details of disciplinary actions, if any, taken against the auditor

Practical Example: Continuing with our example, ABC & Co. Chartered Accountants, having audited XYZ Ltd., must file the NFRA-2 form by November 30th of the subsequent year. This form will include comprehensive details of all audit reports issued by ABC & Co. during the financial year, the fees received for these audits, and a declaration of compliance with relevant auditing standards. Additionally, ABC & Co. must disclose any disciplinary actions faced during the year.

Key Differences Summarized

- Filer:

- NFRA-1: Filed by companies to inform NFRA about their appointed auditors.

- NFRA-2: Filed by auditors to provide an annual return of their activities and compliance.

- Timing:

- NFRA-1: Within 30 days of the auditor’s appointment.

- NFRA-2: Annually by November 30th following the end of the financial year.

- Content:

- NFRA-1: Basic details of the company and its appointed auditors.

- NFRA-2: Comprehensive details about the auditor’s audit reports, fees, compliance, and any disciplinary actions.

Table-wise Difference Between NFRA-1 and NFRA-2 Forms by Auditors

Understanding the differences between NFRA-1 and NFRA-2 is essential for both companies and auditors to ensure compliance with the regulations set forth by the National Financial Reporting Authority (NFRA) under the Companies Act, 2013. The following table highlights the key distinctions between these two forms.

| Aspect | NFRA-1 | NFRA-2 |

|---|---|---|

| Purpose | Notification of the appointment of auditors by companies to NFRA. | Annual return by auditors regarding their activities, audit reports, and compliance status. |

| Filing Entity | Companies (including listed companies and certain large unlisted public companies). | Auditors of companies under NFRA’s jurisdiction. |

| Who Must File | Companies required to adhere to NFRA regulations. | Auditors of listed companies, large unlisted public companies, and other specified entities. |

| Filing Deadline | Within 30 days of the appointment of the auditor. | Annually by November 30th of the year following the financial year to which the return relates. |

| Form Content | – Company identification details (CIN, name, address, etc.) | – General information about the auditor (name, membership number, firm registration number, etc.) |

| – Details of the appointed auditors (name, membership number, firm registration number, etc.) | – Details of audit reports issued during the financial year | |

| – Date of auditor’s appointment | – Information on the audit fees received | |

| – Details of the financial year for which the auditor is appointed | – Declaration of compliance with auditing standards and ethical guidelines | |

| – Details of disciplinary actions, if any, taken against the auditor | ||

| Primary Focus | Informing NFRA about the appointment of the auditors for record-keeping and oversight. | Providing a detailed account of the auditor’s professional conduct and compliance annually. |

| Regulatory Section | Section 132 of the Companies Act, 2013 | Section 132 of the Companies Act, 2013 |

| Relevance | Ensures NFRA has up-to-date information on auditors associated with companies it oversees. | Ensures ongoing oversight of auditors’ activities and adherence to professional standards. |

| Impact on Companies | Companies must ensure timely and accurate filing to avoid penalties and ensure compliance. | No direct impact on companies, but affects auditors associated with them. |

| Impact on Auditors | Indirect, as companies file this form. Auditors need to provide correct information to companies. | Direct, as auditors themselves file this form and must ensure all information is accurate and complete. |

| Compliance Requirement | Part of initial compliance upon the appointment of an auditor. | Part of continuous compliance, required annually. |

| Penalties for Non-Compliance | Penalties and disciplinary action against companies for failing to file or providing incorrect information. | Penalties and disciplinary action against auditors for failing to file or providing incorrect information. |

Detailed Explanation

Purpose and Filing Entity

- NFRA-1 is filed by companies to notify NFRA about the appointment of their auditors. This ensures that NFRA maintains an accurate record of auditors responsible for auditing the financial statements of these companies.

- NFRA-2 is filed by auditors themselves. It serves as an annual return providing detailed information about their audit activities, compliance with standards, and any disciplinary actions faced.

Filing Deadline and Form Content

- NFRA-1 must be filed within 30 days of the auditor’s appointment. It includes basic details about the company and the appointed auditor, such as identification details, appointment date, and financial year details.

- NFRA-2 must be filed annually by November 30th following the financial year. It requires comprehensive information from the auditors, including audit reports issued, audit fees, compliance declarations, and any disciplinary actions.

Primary Focus and Regulatory Section

- The primary focus of NFRA-1 is to inform NFRA about the appointment of auditors, enabling the authority to keep track of which auditors are associated with which companies.

- NFRA-2 focuses on the continuous oversight of auditors’ activities. It ensures that auditors adhere to professional standards and report accurately on their audit practices.

Relevance and Impact

- NFRA-1 is crucial for companies as it forms part of their initial compliance upon appointing an auditor. Timely filing helps avoid penalties and ensures compliance with NFRA regulations.

- NFRA-2 is vital for auditors as it involves continuous compliance. Filing this form accurately and on time ensures that auditors maintain their professional standing and comply with NFRA’s regulatory framework.

Penalties for Non-Compliance

- Companies failing to file NFRA-1 or providing incorrect information may face penalties and disciplinary action, affecting their compliance status.

- Auditors failing to file NFRA-2 or providing inaccurate details may also face penalties and disciplinary actions, impacting their professional credibility and ability to practice.

Performa Contents, Filing Process, and Fee for NFRA-1 and NFRA-2

Understanding the specific content requirements and filing processes for NFRA-1 and NFRA-2 is crucial for ensuring compliance with the National Financial Reporting Authority (NFRA) regulations under the Companies Act, 2013. Below are the details for both forms, including their performance contents, filing processes, and applicable fees.

NFRA-1: Notification by Companies

1. Performa Contents:

- Company Details:

- Corporate Identification Number (CIN)

- Name of the company

- Registered office address

- Email ID and phone number of the company

- Auditor Details:

- Name of the audit firm or individual auditor

- Membership number of the auditor

- Firm registration number (if applicable)

- Address and contact details of the auditor

- Appointment Details:

- Date of the board meeting or annual general meeting where the auditor was appointed

- Financial year for which the auditor has been appointed

- Duration of the appointment (from and to dates)

- Nature of the appointment (first appointment or reappointment)

2. Filing Process:

- Preparation:

- Collect all necessary details about the company and the appointed auditor.

- Ensure the information is accurate and complete to avoid any discrepancies.

- Submission:

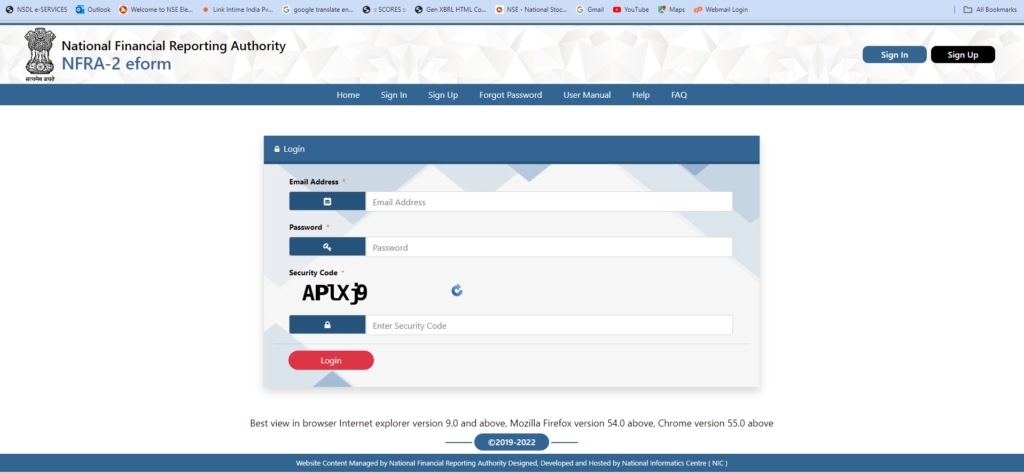

- Log in to the NFRA’s e-filing portal using the company’s credentials.

- Fill out the NFRA-1 form with the required details.

- Upload any supporting documents if required.

- Review the form to ensure all information is correct.

- Confirmation:

- Submit the form electronically.

- Acknowledgment receipt will be generated upon successful submission.

- Retain the acknowledgment for future reference.

3. Filing Fee:

- There is no specific fee prescribed for filing NFRA-1. However, companies should confirm the latest requirements on the NFRA portal or related official notifications.

NFRA-2: Annual Return by Auditors

1. Performa Contents:

- Auditor Information:

- Name of the audit firm or individual auditor

- Membership number

- Firm registration number (if applicable)

- Address and contact details

- Audit Details:

- List of companies audited during the financial year

- Details of audit reports issued (company name, date of report, type of report)

- Audit fees received from each company

- Compliance Information:

- Declaration of compliance with auditing standards

- Declaration of adherence to ethical guidelines issued by the Institute of Chartered Accountants of India (ICAI)

- Disciplinary Actions:

- Details of any disciplinary actions taken against the auditor during the financial year

- Outcome and status of any ongoing disciplinary proceedings

2. Filing Process:

- Preparation:

- Gather detailed information on all audits conducted during the financial year.

- Ensure that all compliance declarations and disciplinary action details are accurately documented.

- Submission:

- Log in to the NFRA’s e-filing portal using the auditor’s credentials.

- Fill out the NFRA-2 form with the necessary details.

- Upload any supporting documents as required.

- Carefully review the form to ensure all information is correct.

- Confirmation:

- Submit the form electronically.

- An acknowledgment receipt will be generated upon successful submission.

- Keep the acknowledgment for future reference.

3. Filing Fee:

- As with NFRA-1, there is typically no specific fee prescribed for filing NFRA-2. Auditors should verify the latest fee structure and requirements on the NFRA portal or through official notifications.

Filing Deadline of NFRA-2 form Explained Below

The NFRA-2 form is an annual return that must be filed by auditors under the purview of the National Financial Reporting Authority (NFRA) as per Rule 5 of the NFRA Rules, 2018. Here’s how to determine which year’s audit it applies to when filing before 30th November:

- Filing Timeline:

- NFRA-2 for the previous financial year (FY) is typically due by 30th November of the current year.

- For instance, if you are filing NFRA-2 before 30th November 2024, it will pertain to the previous financial year (2023-2024).

- Key Clarification:

- Filing before 30th November 2024 corresponds to the audit of FY 2023-24.

- Filing for FY 2024-25 will only be due by 30th November 2025.

- Details to Include:

- Audit information related to the previous year (2023-24 in this case).

- Statutory compliance details as per NFRA requirements for the past year.

Rule Governing NFRA-2 Filing

- Rule 5(1) of NFRA Rules, 2018:“Every auditor referred to in Rule 3 shall file a return with the Authority on or before the 30th of November of every year, in such form as may be specified by the Central Government.”

This means the NFRA-2 is an annual return that pertains to the previous financial year (FY) and must be submitted by 30th November of the current year.

Scenario: Audit Report and Financial Statement up to 31-03-2024

If you prepare the financial statement and audit report for the year ending 31st March 2024, here’s how it applies:

- NFRA-2 Filing Date:

- The return for the audit performed during FY 2023-24 (1st April 2023 to 31st March 2024) must be filed on or before 30th November 2024.

- Details to be Included in the Return:

- NFRA-2 filed by 30th November 2024 must report:

- Details of audits performed during the previous financial year (2023-24).

- This includes information related to audit clients, financial statements audited, and compliance requirements for FY 2023-24.

- NFRA-2 filed by 30th November 2024 must report:

- Current Financial Year Audit (2024-25):

- Any audits performed for the period starting 1st April 2024 will only be included in the NFRA-2 return filed by 30th November 2025.

Relevant Legal and Circular References

- Rule 3 of NFRA Rules, 2018:

- Specifies the class of companies and auditors under NFRA’s jurisdiction, including:

- Listed companies,

- Unlisted public companies meeting certain thresholds,

- Other entities as notified.

- Specifies the class of companies and auditors under NFRA’s jurisdiction, including:

- Circular from NFRA dated 13th November 2019:

- Clarifies the procedural aspects of filing NFRA-2 and emphasizes that the return relates to audits performed in the previous financial year.

- Section 132 of the Companies Act, 2013:

- Establishes the framework for NFRA’s authority and oversight, including the requirement for auditors to file NFRA-2 as part of compliance.

Conclusion

- If you prepare the audit report and financial statements up to 31st March 2024, you must include these details in the NFRA-2 form filed by 30th November 2024, as it pertains to the previous financial year (2023-24).

- The current financial year’s audits (2024-25) will only be reported in the NFRA-2 filing due by 30th November 2025.

Link of FAQ’s – https://eformnfra2.nic.in/resources/docs/NFRA2_FAQ.pdf

Summary Table

| Aspect | NFRA-1 | NFRA-2 |

|---|---|---|

| Purpose | Notification of auditor appointment by companies | Annual return of audit activities by auditors |

| Filing Entity | Companies | Auditors |

| Contents | – Company details | – Auditor details |

| – Auditor details | – Audit details | |

| – Appointment details | – Compliance information | |

| – Disciplinary actions | ||

| Filing Process | – Collect information | – Gather audit details |

| – Log in to NFRA portal | – Log in to NFRA portal | |

| – Fill and submit form | – Fill and submit form | |

| – Receive acknowledgment | – Receive acknowledgment | |

| Filing Deadline | Within 30 days of auditor appointment | Annually by November 30th |

| Fee | Generally no fee | Generally no fee |

Conclusion

Both NFRA-1 and NFRA-2 play critical roles in maintaining transparency and accountability in financial reporting. Proper understanding of their contents, filing processes, and deadlines ensures compliance with NFRA regulations, thereby upholding the integrity of financial information within the corporate sector. Always refer to the latest guidelines and notifications from NFRA for any updates or changes in the filing requirements.