Understanding GST Registration 2024: A Step-by-Step Guide

GST Registration 2024: Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. GST is an indirect tax that has replaced many indirect taxes in India, such as the excise duty, VAT, services tax, etc. To comply with the provisions of GST law, businesses with an annual turnover exceeding the threshold limit prescribed by the government are required to register under GST. The process of GST registration can be straightforward if the steps are followed methodically. Here is a detailed, step-by-step guide to help you understand and complete your GST registration.

Table of Contents

Step 1: Determine Eligibility

Before proceeding with GST registration, it is crucial to determine whether your business needs to register. Generally, businesses with an annual turnover exceeding Rs. 20 lakh (Rs. 10 lakh for special category states) are required to register. However, certain businesses, such as those involved in interstate supply, e-commerce, or casual taxable persons, must register regardless of turnover.

Step 2: Gather Required Documents

Prepare the necessary documents for registration. These typically include PAN of the business or applicant, proof of business registration or incorporation certificate, identity and address proof of promoters/directors with photographs, address proof of the business place, bank account statement/cancelled cheque, and digital signature.

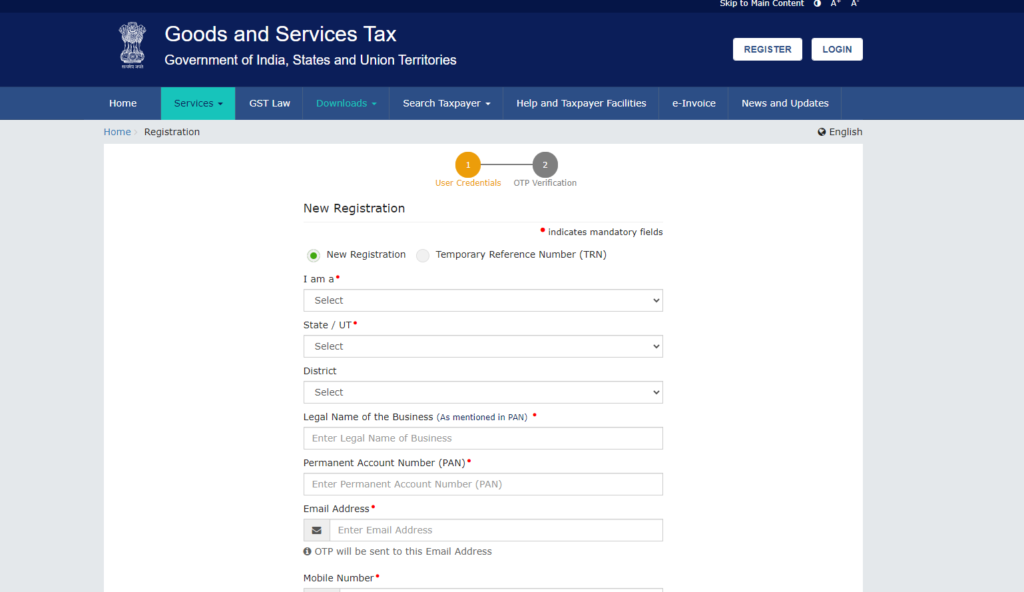

Step 3: Access the GST Portal

Visit the official GST portal (https://www.gst.gov.in/). Click on ‘Services’ > ‘Registration’ > ‘New Registration’. You will be directed to the registration form where you need to fill in the necessary details, such as business name, PAN, mobile number, email address, and state. An OTP will be sent to the provided mobile number and email address for verification.

Step 4: Fill in Part A of the Registration Form

Enter the OTPs received for verification and proceed to fill in Part A of the registration form. This includes entering the details such as legal name of the business (as per PAN), PAN of the business, email address, and mobile number.

Step 5: Fill in Part B of the Registration Form

Once Part A is completed, you will receive a Temporary Reference Number (TRN). Use this TRN to access Part B of the registration form. Here, you need to provide detailed information about the business, including details of promoters/directors, authorized signatory, principal place of business, additional places of business, and details of goods and services to be supplied.

Step 6: Upload Documents

Upload the scanned copies of the required documents in the specified format and size. Make sure the documents are clear and legible to avoid rejection of your application.

Step 7: Verification and Submission

After filling in the details and uploading the documents, verify the application using Digital Signature Certificate (DSC) or Electronic Verification Code (EVC). Once verified, submit the application.

Step 8: ARN Generation

Upon successful submission, you will receive an Application Reference Number (ARN) via email and SMS. You can use this ARN to track the status of your application on the GST portal.

Step 9: Approval and GSTIN Issuance

The GST authorities will verify your application and documents. If everything is found to be in order, your application will be approved, and a GST Identification Number (GSTIN) will be issued. You will be notified of the approval and can download the GST registration certificate from the GST portal.

Step 10: Post-Registration Compliance

After obtaining GST registration, ensure compliance with GST laws, including timely filing of GST returns, payment of taxes, and maintaining proper records. Non-compliance can result in penalties and legal complications.

By following these steps, businesses can ensure a smooth GST registration process, enabling them to comply with the tax regulations and take advantage of the benefits provided under the GST regime.

How to Register for GST Online: Everything You Need to Know

Registering for the Goods and Services Tax (GST) is a critical step for businesses in India to comply with tax regulations. The GST registration process is designed to be user-friendly and can be completed online via the GST portal. Here’s a detailed guide to help you through the process.

First, gather all necessary documents. You’ll need your PAN card, Aadhaar card, proof of business registration or incorporation certificate, identity and address proof of promoters/directors, business address proof, and bank account statement or a canceled cheque. Additionally, a digital signature (DSC) or e-sign is required for authentication purposes.

To begin, visit the GST portal (www.gst.gov.in) and click on the ‘Services’ tab. Under ‘Registration,’ select ‘New Registration.’ You will be prompted to enter details such as your legal name of the business (as per PAN), PAN of the business, email address, and mobile number. An OTP will be sent to your mobile and email for verification. Once verified, a Temporary Reference Number (TRN) will be generated and sent to your email and mobile.

Next, log in with the TRN on the GST portal to proceed with Part B of the registration. Fill in the various sections including business details, promoter details, authorized signatory, principal place of business, additional places of business, goods and services, bank accounts, and verification. Ensure that you upload the necessary documents in the prescribed formats.

After filling in all the details and uploading documents, you need to verify the application using DSC or Aadhaar-based e-sign. Once verified, submit the application. You will receive an Application Reference Number (ARN) via email and SMS, which can be used to track the status of your application.

The GST officer will review your application and if all details and documents are in order, your GSTIN (GST Identification Number) will be issued. This process typically takes a few working days. If there are any discrepancies or further clarifications required, you will be notified to provide the necessary information.

Successfully registering for GST not only ensures compliance but also allows your business to avail input tax credits and seamlessly conduct business across states. The online process is designed to be efficient and transparent, making it easier for businesses to register and start their operations under the GST regime.

Navigating the GST Portal: A Comprehensive Login Guide

The GST portal is a crucial tool for businesses to manage their GST compliance, from registration to return filing. Navigating the GST portal efficiently begins with understanding the login process. Here’s a comprehensive guide to help you log in and make the most of the GST portal’s features.

To start, visit the GST portal (www.gst.gov.in). On the homepage, click on the ‘Login’ button located at the top right corner. You will be directed to the login page where you need to enter your username and password, created during your GST registration. Additionally, enter the captcha code displayed on the screen for security verification.

If you’ve forgotten your username or password, you can use the ‘Forgot Username’ or ‘Forgot Password’ options. For ‘Forgot Username,’ you’ll need your GSTIN or PAN, registered email, and mobile number to retrieve it. For ‘Forgot Password,’ enter your username and follow the instructions sent to your registered email or mobile to reset it.

Once logged in, you’ll be taken to the dashboard. The dashboard provides an overview of your GST profile, including notices, return filing status, and payments. From here, you can access various services such as filing returns, viewing ledgers, making payments, and managing user profiles.

To file a return, navigate to the ‘Services’ tab, select ‘Returns,’ and then ‘File Returns.’ Choose the relevant financial year and return filing period, and follow the steps to enter details and submit your return. For payments, go to ‘Services,’ select ‘Payments,’ and follow the prompts to generate and pay challans.

Regularly checking your dashboard for notices and pending actions is essential to remain compliant. The GST portal’s intuitive design ensures that even those new to GST can navigate it with ease, making it a valuable resource for businesses of all sizes.

Troubleshooting GST Portal Login Issues: Tips and Tricks

Logging into the GST Portal can sometimes present challenges, which can be frustrating, especially when you need to access it for urgent tasks. However, with a few tips and tricks, you can troubleshoot common login issues and ensure a smooth experience.

Firstly, ensure that you are using a compatible browser. The GST Portal works best on updated versions of browsers like Google Chrome, Mozilla Firefox, and Microsoft Edge. Clearing your browser cache and cookies can also help resolve loading issues. If the portal isn’t loading correctly, try switching to a different browser to see if the problem persists.

Secondly, double-check your internet connection. A stable and high-speed internet connection is crucial for accessing the GST Portal. If your connection is slow or unstable, it may cause the portal to time out or fail to load. Restarting your router or switching to a different network can sometimes resolve these issues.

If you are facing issues with your login credentials, make sure you are entering the correct username and password. In case you’ve forgotten your password, use the ‘Forgot Password’ option to reset it. It’s also advisable to check if the Caps Lock key is turned off, as passwords are case-sensitive. Ensure your credentials are not copied with extra spaces, as this can lead to login failures.

For users encountering error messages during login, note the exact error code or message. Common errors like ‘Invalid CAPTCHA’ can be resolved by entering the CAPTCHA code carefully, ensuring it matches exactly what is displayed. If you repeatedly encounter such errors, refresh the page to generate a new CAPTCHA code.

Lastly, if technical issues persist, contact GST helpdesk support. The support team can assist with specific login problems, such as account lockouts or system errors. Keep your GSTIN and relevant details handy for a quicker resolution. By following these tips and tricks, you can effectively troubleshoot and resolve most GST Portal login issues, ensuring uninterrupted access to the services you need.

Your First Login: A Guide to Accessing the GST Portal

Navigating the GST Portal for the first time can be daunting, but with a structured approach, it becomes manageable. The Goods and Services Tax (GST) Portal is a comprehensive platform that allows taxpayers to register, file returns, make payments, and access various GST-related services. Here’s a step-by-step guide to ensure a smooth initial login.

Steps to First-Time Login

- Obtain Provisional ID and Password: Once you’ve applied for GST registration, you will receive a Provisional ID and password via email from the GST department. This is essential for your first login.

- Access the GST Portal: Visit the official GST Portal at https://www.gst.gov.in/. Click on the ‘Login’ button on the top right corner of the homepage.

- Enter Provisional ID and Password: On the login page, enter the Provisional ID and password you received. Upon successful entry, you’ll be prompted to create a new username and password for future logins.

- Set Up Security Questions: For added security, you will be asked to select and answer a few security questions. These will be useful for account recovery in case you forget your password.

- Update Profile Information: After setting up your new login credentials, update your profile with necessary details such as business information, bank details, and contact information.

Hidden Facts and Tips

1. Importance of Security Questions: The security questions might seem trivial, but they are crucial for account recovery. Always choose questions and answers that are memorable to you but hard for others to guess. For example, “What was your first pet’s name?” could be a strong option if you remember it distinctly.

2. Two-Factor Authentication (2FA): Although not widely publicized, the GST Portal supports Two-Factor Authentication. Enabling 2FA adds an extra layer of security by requiring a one-time password (OTP) sent to your registered mobile number. This can significantly reduce the risk of unauthorized access.

3. Multiple User Profiles: The GST Portal allows the creation of multiple user profiles under a single GSTIN. This feature is particularly useful for larger businesses where different departments or individuals manage GST compliance. For example, the finance team can handle returns while the IT department manages technical aspects of the portal.

4. Digital Signature Certificate (DSC): While filing returns or making certain changes, you might be required to use a Digital Signature Certificate (DSC). Ensure your DSC is registered on the portal. The use of DSC provides a higher level of security for transactions and filings.

Navigating the GST Portal becomes intuitive once you are familiar with its features. Ensuring your information is accurate and up-to-date will help avoid complications during tax filings and other transactions. Taking advantage of security features like 2FA and DSC can safeguard your account from potential breaches, providing a smoother and more secure GST experience.

GST Portal Navigation: From Registration to Return Filing

Navigating the GST portal is crucial for businesses and individuals required to comply with GST regulations in India. The GST portal, designed by the Goods and Services Tax Network (GSTN), serves as a comprehensive platform for all GST-related activities, from registration to return filing.

GST Registration

The first step for any business is to register on the GST portal. Registration is mandatory for businesses with a turnover exceeding ₹20 lakhs (₹10 lakhs for North-Eastern and hill states). To register, visit the GST portal (www.gst.gov.in) and complete the online application form. You’ll need to provide details like your PAN, mobile number, email address, and the nature of your business. After submitting the form, you will receive an Application Reference Number (ARN) via email and SMS. The tax authorities will then verify your application and, upon successful verification, issue a GSTIN (Goods and Services Tax Identification Number).

GST Portal Login

Once registered, logging into the GST portal is essential for managing your GST compliance. Use your GSTIN and the password created during registration to access your account. The portal’s dashboard provides an overview of your GST profile, including pending tasks, filed returns, and notifications. An often-overlooked feature is the “Help and Taxpayer Facilities” section, which offers comprehensive guides and FAQs.

Return Filing

Filing returns is a critical function of the GST portal. Regular taxpayers must file GSTR-1 (sales return) monthly, GSTR-3B (summary return) monthly, and GSTR-9 (annual return). Composition scheme taxpayers have different return forms. One hidden gem is the “Auto-populate” feature in GSTR-3B, which pulls data from GSTR-1 and GSTR-2A, reducing manual entry errors. For instance, if you have already reported your sales in GSTR-1, those figures will auto-populate in GSTR-3B, ensuring consistency and saving time.

Hidden Facts

An unknown fact about the GST portal is its facility for integrating e-way bills directly with return filings. This integration ensures that the data entered for transportation of goods seamlessly flows into your GSTR-1, minimizing discrepancies. For example, if you generate an e-way bill for transporting goods worth ₹50,000, the details will automatically reflect in your GSTR-1.

Another lesser-known feature is the “Offline Tools” available on the portal. These tools allow taxpayers to prepare their returns offline, which is particularly useful for businesses with limited internet connectivity. For instance, the GSTR-1 Offline Tool lets you download your data, prepare the return offline, and then upload it when you have a stable internet connection.

In conclusion, mastering the navigation of the GST portal, from registration to return filing, is vital for ensuring compliance and leveraging the portal’s full potential. The integration features and offline tools are designed to simplify the process, making GST compliance more accessible and efficient.

Common Challenges in GST Registration and How to Overcome Them

GST registration, though designed to be straightforward, often presents several challenges to businesses, especially new entrants. Understanding these challenges and how to navigate them can save time and reduce frustration.

Technical Issues and Portal Glitches: One of the most common hurdles is dealing with technical glitches on the GST portal. Users frequently encounter slow loading times, session timeouts, and unexpected errors during the registration process. For example, during peak filing periods, the portal can become overwhelmed, causing delays and forcing users to restart the process multiple times. Overcoming this involves ensuring a stable internet connection and attempting registration during off-peak hours when the portal is less likely to be congested.

Document Upload Errors: Another significant challenge is the rejection of uploaded documents. The GST portal has strict guidelines on the format and size of documents. For instance, PAN card scans must be clear and legible, and the file size should not exceed the specified limit. Many users unknowingly upload blurry images or incorrect formats, leading to rejections. To prevent this, it is crucial to carefully follow the guidelines provided on the portal and use document scanning tools that ensure clarity and proper format.

Mismatch in Information: Mismatched information between documents is a frequent issue. Details on the PAN card, Aadhar card, and bank statements must match exactly. Even a minor discrepancy in the spelling of a name or address can result in the application being rejected. For example, if a business name is listed as “ABC Pvt. Ltd.” on one document and “ABC Private Limited” on another, this could cause a problem. Double-checking all documents for consistency before submission is essential to avoid this pitfall.

Navigating Multiple Forms and Fields: The GST registration process involves filling out various forms and fields, which can be overwhelming. Each section requires specific details, and missing information can lead to delays. For instance, businesses need to provide information about their business operations, bank account details, and digital signature certificates (DSC). Utilizing the help resources available on the GST portal and seeking professional advice can simplify this process.

Verification Delays: After submission, the verification process can also cause delays. The GST department verifies the authenticity of the provided information, and any discrepancies can result in further scrutiny and delays. For example, if the verification process raises doubts about the business address, physical verification may be initiated, prolonging the registration process. Ensuring all details are accurate and providing additional proof of address, like utility bills or lease agreements, can expedite verification.

Hidden Facts and Examples

Error Codes: The GST portal often provides specific error codes when something goes wrong. Understanding these codes can help users troubleshoot issues more effectively. For example, error code “GSTR-3B: Invalid Return” indicates issues with the monthly return filing, which can be corrected by reviewing the return details.

Advanced Helpdesk: The GST portal has an advanced helpdesk that many users overlook. This helpdesk can provide real-time assistance and detailed FAQs to resolve common issues quickly.

Pre-registration Checks: Businesses can perform pre-registration checks using tools available on the portal. These tools can validate the PAN and business details before actual submission, reducing the chances of errors.

By being aware of these common challenges and hidden resources, businesses can navigate the GST registration process more smoothly and efficiently.

If you too have love for writing and willing to showcase your article related to corporate laws and allied laws, Kindly mail us the word file on [email protected]

[email protected]