Are you considering a career as an Independent Director in India? The Independent Director course offered by the Indian Institute of Corporate Affairs (IICA) could be your gateway to success. In this blog post, we’ll delve into what the course entails, why it’s valuable, and how it can benefit aspiring directors like you.

What is the Independent Director Course?

The Independent Director Course offered by IICA is a comprehensive program designed to equip individuals with the knowledge, skills, and mindset required to serve effectively as Independent Directors on the boards of Indian companies. The course covers various aspects of corporate governance, regulatory framework, ethical considerations, and boardroom dynamics.

Table of Contents

What is an Independent Director?

An Independent Director is a crucial position on the board of directors of a company. Unlike other directors who may have ties to the company, independent directors are expected to bring an unbiased perspective and act in the company’s and its stakeholders’ best interests.

Why is Certification Important?

Certification for Independent Directors is mandated by the Companies Act, 2013 in India. It ensures that individuals appointed as Independent Directors possess the necessary knowledge, skills, and integrity to fulfill their responsibilities effectively.

Independent Director Salary in India

Are you curious about the compensation structure for Independent Directors in India? Let’s clear up any confusion. Contrary to traditional employment arrangements, Independent Directors don’t receive salaries. Instead, they earn sitting fees for attending board meetings and fulfilling their duties. In this blog post, we’ll explore what sitting fees entail, how they’re determined, and why it’s important to understand this distinction.

What are Sitting Fees?

Sitting fees are payments made to Independent Directors for each board meeting they attend. These fees compensate directors for their time, expertise, and contributions during board discussions and decision-making processes. Sitting fees are typically fixed amounts agreed upon by the company’s board of directors and are subject to regulatory guidelines.

How are Sitting Fees Determined?

The determination of sitting fees is based on various factors, including the size and complexity of the company, the industry it operates in, the time commitment required from directors, and prevailing market practices. Companies may establish sitting fees within the limits prescribed by regulatory authorities to ensure fairness and transparency.

Why It Matters:

Understanding the distinction between sitting fees and salaries is essential for both companies and Independent Directors:

- Regulatory Compliance: Adhering to regulatory guidelines regarding Independent Director compensation helps companies avoid legal risks and maintain compliance with corporate governance norms.

- Transparency and Accountability: Transparent disclosure of sitting fees in annual reports and other corporate communications enhances transparency and accountability, fostering trust among stakeholders.

- Independence and Objectivity: Independent Directors’ compensation structure, free from salary-based incentives, reinforces their independence and objectivity in boardroom deliberations and decision-making processes.

- Aligning Interests: Sitting fees align the interests of Independent Directors with those of shareholders by incentivizing active participation and value creation without creating conflicts of interest.

Who Needs to Get Certified?

Any individual who wishes to serve as an Independent Director on the board of a company in India must obtain certification. This applies to both existing and prospective directors.

INDEPENDENT DIRECTOR CERTIFICATION PROGRAM

How to Get Certified:

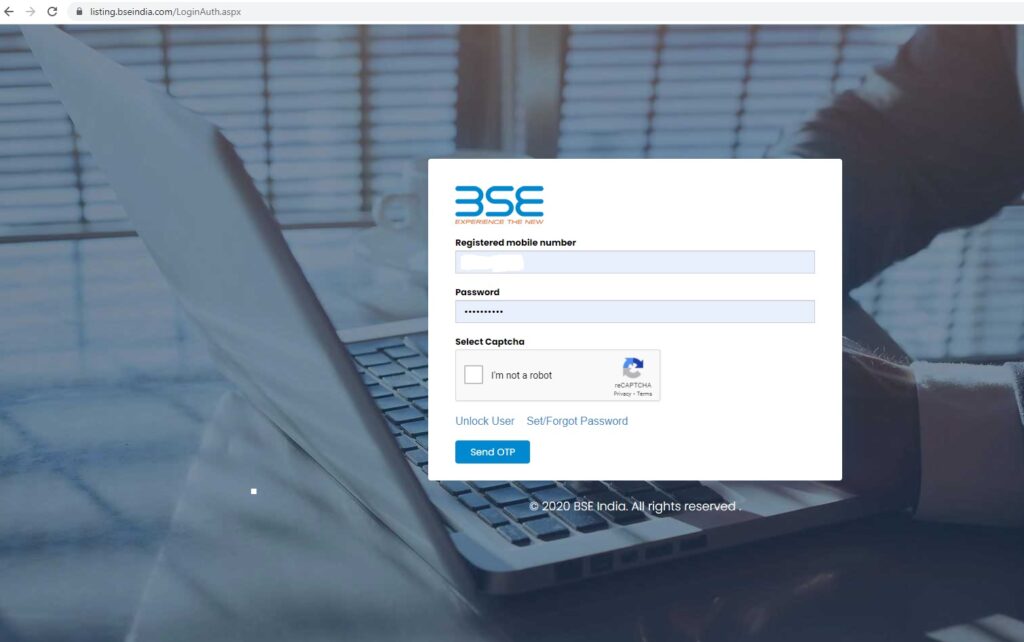

- Choose an Accredited Institution: Look for institutions accredited by the Securities and Exchange Board of India (SEBI) or the Indian Institute of Corporate Affairs (IICA). These institutions offer programs specifically designed to provide the requisite knowledge and skills for Independent Directors.

- Enroll in a Certification Program: Once you’ve identified an accredited institution, enroll in their Independent Director certification program. These programs typically cover topics such as corporate governance, legal and regulatory framework, financial literacy, and boardroom dynamics.

- Complete the Program: Attend the training sessions and complete all the required coursework as per the curriculum. This may involve classroom sessions, workshops, case studies, and assessments to test your understanding of the subject matter.

- Obtain Certification: Upon successful completion of the program, you will be awarded a certificate validating your status as a certified Independent Director.

Key Features of the Independent Director Course:

- Accreditation: The course is accredited by IICA, ensuring that it meets the highest standards of quality and relevance in the field of corporate governance.

- Comprehensive Curriculum: The curriculum covers a wide range of topics, including corporate law, financial management, risk management, and stakeholder engagement, providing participants with a holistic understanding of their roles and responsibilities as Independent Directors.

- Expert Faculty: The course is delivered by experienced faculty members who are experts in their respective fields, ensuring that participants receive high-quality instruction and guidance throughout the program.

- Interactive Learning: The course incorporates interactive learning methodologies, including case studies, group discussions, and practical exercises, allowing participants to apply theoretical concepts to real-world scenarios and enhance their learning experience.

- Flexibility: The course is designed to accommodate the busy schedules of professionals, with both online and offline delivery modes available. Participants can choose the format that best suits their needs and preferences.

What is an Independent Director Certification Program?

An Independent Director Certification Program is a structured training course designed to equip individuals with the knowledge, skills, and competencies required to serve effectively as Independent Directors on the boards of companies. These programs typically cover topics such as corporate governance, legal and regulatory framework, financial literacy, ethics, and boardroom dynamics.

Why is Independent Director Certification Important?

Certification for Independent Directors is mandated by the Companies Act, 2013 in India. It ensures that individuals appointed as Independent Directors possess the necessary expertise and integrity to fulfill their responsibilities effectively. Certification also enhances the credibility of Independent Directors and helps build trust among stakeholders.

Independent Director Certification Programs play a crucial role in preparing individuals for the responsibilities and challenges associated with serving as Independent Directors in India. By completing a certification program, you can enhance your competence, credibility, and career prospects in the dynamic field of corporate governance. So, if you’re ready to take the next step in your journey toward becoming an Independent Director, consider enrolling in a certification program today!

Key Components of Independent Director Certification Programs:

- Comprehensive Curriculum: Certification programs offer a comprehensive curriculum that covers essential topics relevant to the role of Independent Directors. This includes corporate governance principles, legal and regulatory requirements, financial management, risk assessment, and stakeholder engagement.

- Expert Faculty: Certification programs are led by experienced faculty members who are experts in corporate governance, law, finance, and related fields. They provide participants with valuable insights, practical examples, and real-world perspectives to enrich their learning experience.

- Interactive Learning: Certification programs often incorporate interactive learning methodologies such as case studies, group discussions, role-plays, and simulations. This interactive approach enables participants to apply theoretical concepts to practical situations and enhance their decision-making skills.

- Assessments and Examinations: Certification programs may include assessments and examinations to evaluate participants’ understanding of the course material. These assessments help ensure that participants have acquired the necessary knowledge and skills to serve as Independent Directors effectively.

Benefits of the Independent Director Course:

- Enhanced Knowledge and Skills: By completing the Independent Director course, participants gain a deep understanding of corporate governance principles, legal requirements, and best practices, enabling them to contribute effectively to boardroom deliberations and decision-making processes.

- Professional Credibility: Certification from IICA is widely recognized and respected in the corporate sector, enhancing participants’ credibility and employability as Independent Directors.

- Networking Opportunities: The course provides participants with opportunities to interact with industry experts, fellow professionals, and thought leaders in the field of corporate governance, facilitating networking and knowledge sharing.

- Career Advancement: Completion of the Independent Director course opens up new career opportunities for participants, allowing them to serve as Independent Directors on the boards of various companies and make a meaningful impact on corporate governance practices in India.

What Does Independent Director Certification Involve?

- Accredited Programs: Look for certification programs accredited by reputable institutions like the Indian Institute of Corporate Affairs (IICA) or the Institute of Company Secretaries of India (ICSI). These programs adhere to stringent quality standards and cover essential topics relevant to Independent Directors.

- Comprehensive Curriculum: Certification programs typically cover a wide range of subjects, including corporate governance principles, legal and regulatory framework, financial literacy, risk management, and ethical considerations. The curriculum is designed to provide participants with a holistic understanding of their roles and responsibilities.

- Rigorous Training: Certification involves rigorous training delivered by experienced faculty members who are experts in corporate governance and related fields. Training methodologies may include classroom sessions, workshops, case studies, and interactive exercises to facilitate active learning and practical application of concepts.

- Assessment and Evaluation: To earn certification, participants must demonstrate their understanding of the course material through assessments and evaluations. This ensures that certified Independent Directors possess the requisite knowledge and skills to fulfill their duties effectively.

The Independent Director course offered by IICA is a valuable opportunity for professionals seeking to pursue a career as Independent Directors in India. With its rigorous curriculum, expert faculty, and industry recognition, the course equips participants with the knowledge, skills, and credentials needed to excel in this important role. So, if you’re ready to take your career to the next level and contribute to the growth and sustainability of Indian businesses, consider enrolling in the Independent Director course by IICA today!

How did Independent director lose their Independence?

In India, the role of an independent director is crucial in ensuring transparency, accountability, and effective governance within companies. As per the Companies Act, 2013, and the Securities and Exchange Board of India (SEBI) guidelines, independent directors are expected to maintain their independence throughout their tenure to uphold the integrity of their role. However, there are several ways through which an independent director can lose their independence, both legally and ethically. Let’s explore these in detail.

- Shareholding: One way an independent director can lose their independence is by acquiring a significant shareholding in the company. As per SEBI regulations, an independent director cannot hold more than a certain percentage of shares in the company, typically 2% or as specified. If an independent director crosses this threshold, they may become influenced by their own financial interests, thereby compromising their independence. Furthermore, a substantial shareholding may imply a vested interest in the company’s performance, which could hinder their ability to objectively evaluate management decisions.

- Employment with the Company or its Affiliates: Joining the company or its affiliates in an executive or managerial capacity can also compromise the independence of a director. Accepting an employment offer from the company or its subsidiaries blurs the line between oversight and management roles, potentially leading to conflicts of interest. An independent director should not be involved in the day-to-day operations of the company to maintain objectivity in their decision-making process. Such involvement may impair their ability to critically evaluate management actions and represent the interests of minority shareholders effectively.

- Receipt of Profit Share or Compensation Tied to Performance: If an independent director receives a share of the company’s profits or any form of compensation linked to the company’s performance, it can undermine their independence. Such arrangements create a direct financial incentive for the director to prioritize the company’s financial interests over their duty to act in the best interest of all stakeholders. Independence demands that directors remain impartial and free from any undue influence, including financial incentives that may cloud their judgment.

- Close Relationships with Promoters or Directors: Independence also implies maintaining a distance from the promoters or other directors of the company. If an independent director develops personal or familial ties with the promoters or management, it can compromise their ability to exercise independent judgment. Close relationships may lead to favoritism, bias, or conflicts of interest, thereby impeding the director’s ability to act in the best interest of the company and its stakeholders.

- Non-disclosure of Conflicts of Interest: Failure to disclose conflicts of interest can severely undermine the independence of a director. Independent directors are required to promptly disclose any conflicts of interest that may arise during their tenure. This includes relationships with related parties, financial interests, or any other situation that could impair their independence. Non-disclosure of conflicts not only violates legal obligations but also erodes trust and undermines the credibility of the director and the board as a whole.

- Lack of Objectivity and Independence in Decision-making: Ultimately, the loss of independence may manifest in the director’s inability to make objective decisions in the best interest of the company and its stakeholders. Independence goes beyond mere compliance with regulations; it requires a mindset committed to fairness, transparency, and integrity. Any actions or behaviors that compromise these principles can erode the independence of a director, regardless of their legal status.

In conclusion, maintaining independence is paramount for directors, especially independent directors, to fulfill their fiduciary duties effectively. Any actions or circumstances that compromise independence not only violate legal provisions but also undermine the credibility of the director and the governance structure of the company. Therefore, directors must remain vigilant, uphold ethical standards, and adhere to regulatory requirements to preserve their independence and fulfill their responsibilities with integrity and diligence.

If you wish to publish your piece of writing or are interested in getting your article posted on Compliance Blogging, please reach out to us at csannusharma@gmail.com. Our dedicated team will promptly respond to assist you in getting your writing published here, showcasing your expertise with your name prominently featured. We look forward to hearing from you and sharing valuable insights with our readers.